Islamic Money Market Operations Unique to Malaysia, the settlement of large-value payments within the Islamic banking sector is conducted via a separate system of Islamic current accounts maintained at Bank Negara Malaysia. This separation ensures a clear segregation of funds between conventional and Islamic banking at the settlement level to ensure compliance from the Shariah perspective. Nonetheless, liquidity in both systems are linked given third-party payments between banking customers in the two sectors, as well as the participation of conventional banking institutions in Islamic banking products. The primary objective of the Bank’s monetary operations in the Islamic money market is to ensure sufficient liquidity for the efficient functioning of the Islamic interbank market.

The monetary policy target is only implemented in the conventional money market, where interest rate based instruments are the primary funding instrument. The Bank influences Islamic interbank market liquidity through an array of Shariah-compliant instruments, the main instrument being the Qard acceptance (loan). Through the Qard acceptance, the Bank manages liquidity in the context of a surplus liquidity environment by inviting Islamic banking institutions to place their surplus funds with the Bank. The Bank also uses Commodity Murabahah Programme (CMP) to manage liquidity. CMP utilises mainly crude palm oil-based contracts as the underlying commodity transactions to facilitate liquidity management via a commodity trading platform such as Bursa Suq Al Sila’, or other commodity providers. For longer-term liquidity management, the Bank issues Bank Negara Monetary Notes-i (BNMN-i) which are structured based on Islamic concepts of Murabahah (BNMN-Murabahah), Ijarah (BNMN-Ijarah) and Istithmar (BNMN-Istithmar). The key objectives of issuing BNMN-i are to increase efficiency and flexibility in liquidity management in the Islamic money market by diversifying Islamic financial instrument and expanding the Shariah concept used in BNM’s Islamic monetary operation.

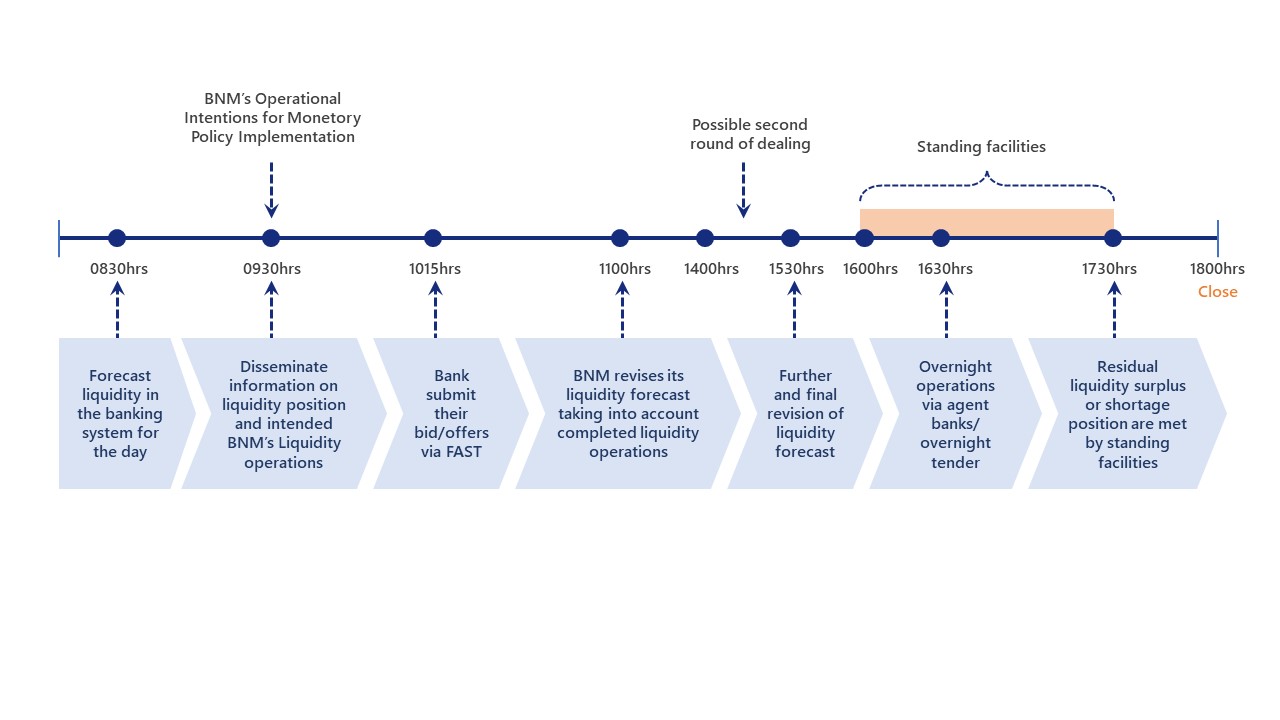

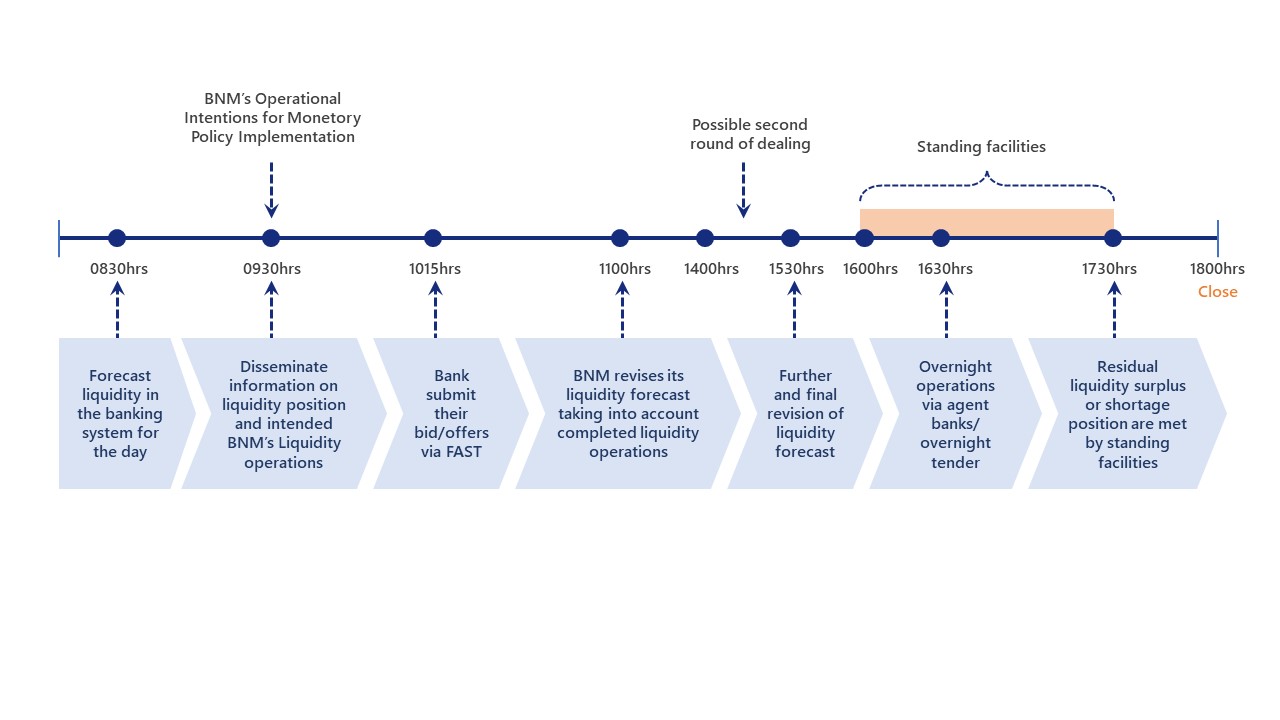

The Bank's daily monetary operations are conducted at 9:30 a.m. ~ 10:15 a.m. and 4:00 p.m. ~ 4:30 p.m., executed via various combinations of monetary instruments.

Liquidity forecast position is announced through FAST before conducting monetary operations. The forecast is based on the analysis of various factors, including the maturity of previous direct borrowing, Islamic repo transactions and securities issued by the Bank, changes in currency-in-circulation, large payments in and out of the Bank, the Federal Government's and Federal Statutory agencies' account balances with the Bank, and adjustments to banking institutions' balances in their statutory reserve accounts (SRA).

In the morning operations, the main instruments are:

- i) Uncollateralized direct borrowings, range maturity auction (RMA), and Islamic repo for short term liquidity management.

- ii) Issuance of BNMN-i to cater for longer term liquidity management.

Meanwhile, both the overnight tenders and standing facilities are made available to the market participants in the evening to manage any surplus or deficit of liquidity in the system for the day. All approved interbank participants are able to participate directly in monetary operations conducted by the bank, including standing facilities. However, participation in BNMN-i auctions is only via appointed Islamic Principle Dealers (i-PDs).

Schedule of Daily Monetary Operations: