Monetary policy operations are wholesale and interbank market transactions undertaken by the Bank to manage liquidity in the financial system, by absorbing or adding liquidity via various types of instruments to achieve its operating target -- the average overnight interbank rate (AOIR).

The primary objective is to ensure the AOIR remains within the corridor of the Overnight Policy Rate (OPR) as set out by the Monetary Policy Committee (MPC) while ensuring the efficient functioning of the conventional and Islamic interbank money market.

Monetary operations with all interbank participants are conducted daily through electronic auctions on the web-based Fully Automated System for Issuing/Tendering (FAST). The auctions can be undertaken in various forms: competitive variable rates, competitive single rate or non-competitive forms. All auction invitations and auction results are published on the FAST website (fast.bnm.gov.my). The Bank may also conduct bilateral operations with financial institutions or intervene through agent banks or via money brokers.

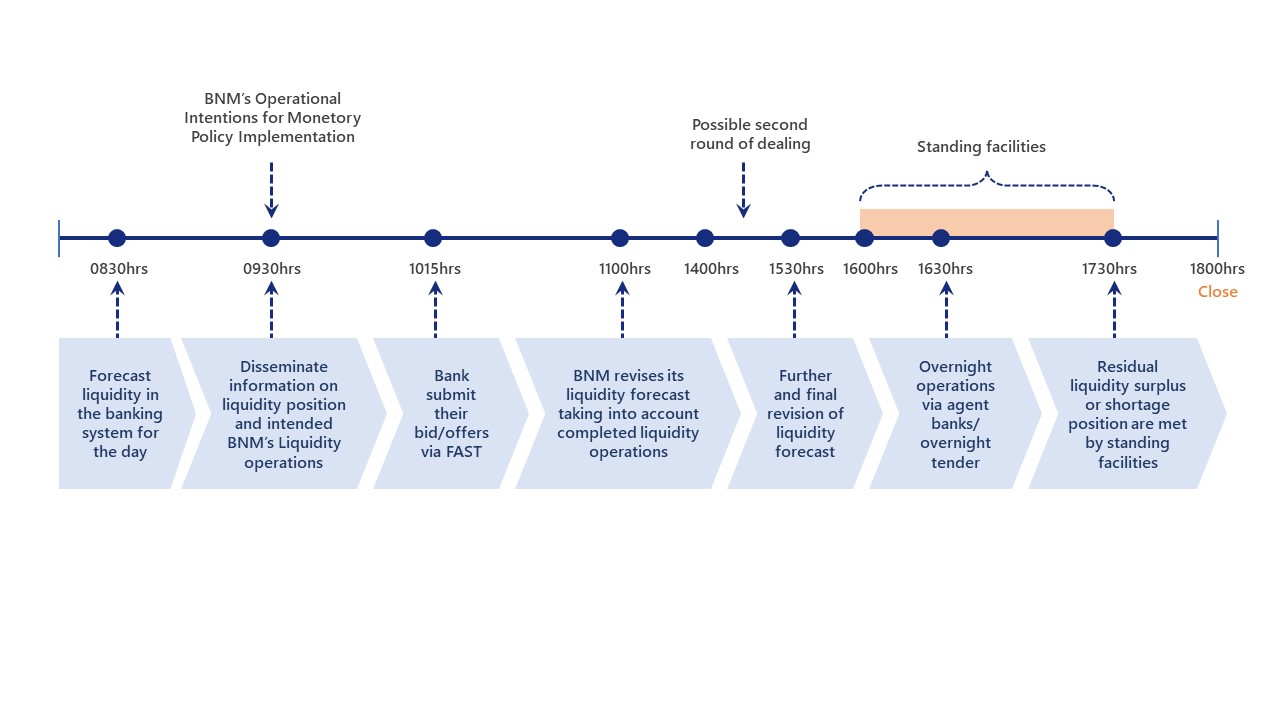

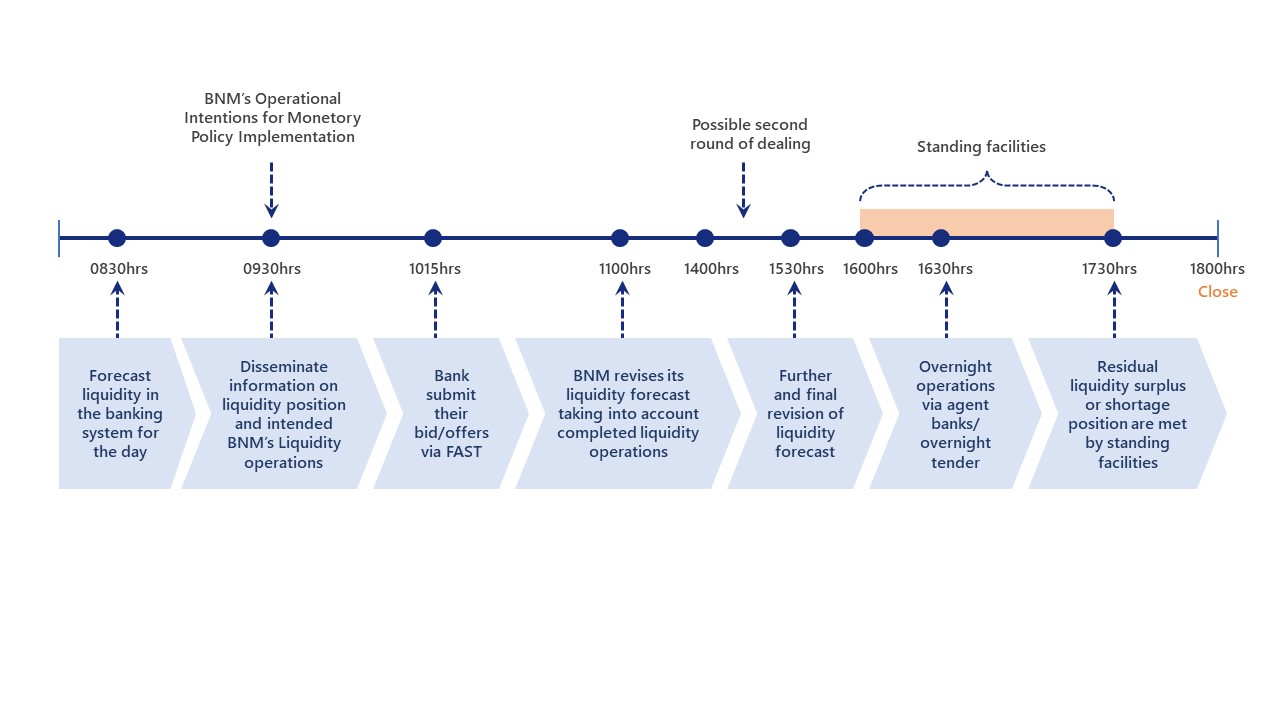

The Bank's daily monetary operations are conducted at 9:30 a.m. ~ 10:15 a.m. and 4:00 p.m. ~ 4:30 p.m., executed via various combinations of monetary instruments.

Liquidity forecast position is announced through FAST before conducting monetary operations. The forecast is based on the analysis of various factors, including the maturity of previous direct borrowing, repo transactions and securities issued by the Bank, changes in currency-in-circulation, large payments in and out of the Bank, the Federal Government's and Federal Statutory agencies' account balances with the Bank, and adjustments to banking institutions' balances in their statutory reserve accounts (SRA).

In the morning operations, the main instruments are:

- Uncollateralized direct borrowings, range maturity auction (RMA), and repo for short term liquidity management

- Issuance of BNMNs to cater for longer term liquidity management.

Meanwhile, both the overnight tenders and standing facilities are made available to the market participants in the evening to manage any surplus or deficit of liquidity in the system for the day. All approved interbank participants are able to participate directly in monetary operations conducted by the bank, including standing facilities. However, participation in BNMN auctions is only via appointed Principle Dealers (PDs).

Schedule of Daily Monetary Operations: